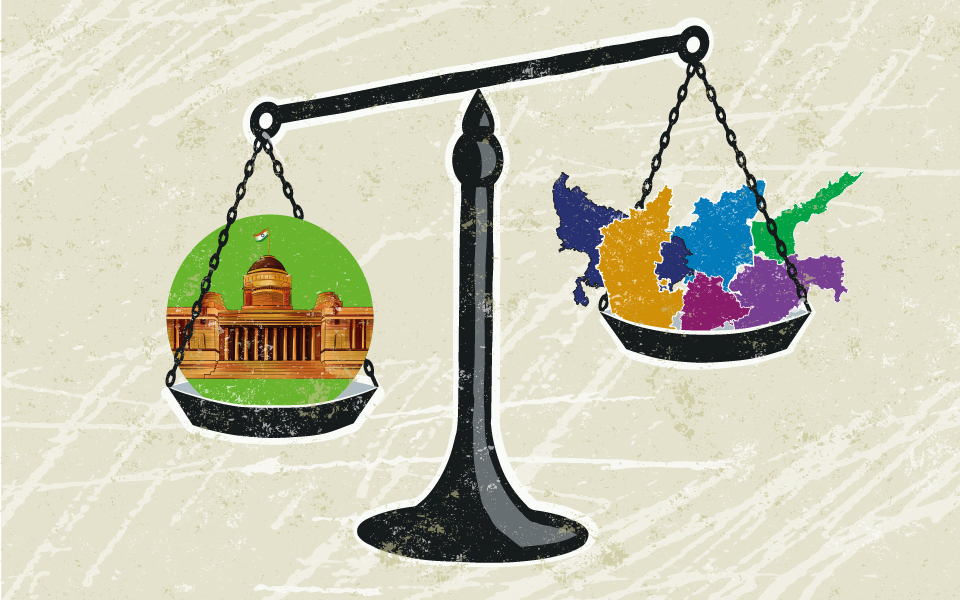

Federalism is a two-tiered governance structure that includes the federal government and a number of states. Federalism is one of the foundations of the Constitution’s Basic Structure.

However, in recent years, the Central Government’s repressive actions, along with the pandemic-induced economic shock, have exacerbated the political and budgetary plight of state governments.

The States are not mere appendages of the Union, as the Supreme Court stated in the S.R. Bommai versus Union of India case, and the latter should guarantee that the States’ powers are not trampled upon.

Federalism in India :-

- The Nature of Indian Federalism: K.C. Wheare, a federal theorist, argues that the Indian Constitution is quasi-federal in nature.

- In Sat Pal v State of Punjab and Ors (1969), the Supreme Court declared that India’s Constitution is more quasi-federal than federal or unitary.

- Constitutional Provisions: Articles 245 to 254 of the Indian Constitution outline the various legislative powers of the states and the central government.

- 7 The Constitution’s Seventh Schedule has three lists that divide authority between the federal government and the states (Article 246).

- The Parliament has sole legislative authority over 98 subjects on the Union List, while the states have sole legislative authority over 59 issues on the State List.

- In the event of a dispute, however, the legislation passed by Parliament takes precedence (Article 254).

- Absolute Power of State in Certain Matters: According to various Supreme Court decisions (such as the State of Bombay vs F.N. Balsara case, 1951), if an enactment falls within one of the matters assigned to the State List and reconciliation with any entry in the Concurrent or Union List is not possible after applying the Doctrine of “Pith and Substance,” the legislative domain of the State Legislature must prevail.

Issues Related to Federalism :-

- Increasing Union Dominance in Fiscal Policies: The Union administration took a number of initiatives that undercut the ideals of fiscal federalism.

- This has shown itself in the following ways: Increasing the States’ monetary share of Centrally Sponsored Schemes (CSS).

- Demonetisation was imposed without proper consultation with the states.

- The Smart Cities Mission’s statutory tasks are being outsourced.

- By 2020-21, the Union government will have contributed 68 percent of the overall petroleum sector contribution, leaving the States with just 32 percent.

- In 2013-14, the Union:State ratio was about 50:50.

- Impact of the Covid-19: The states were restricted in parts of Covid-19 management such as the acquisition of testing kits, immunisation, and the application of the Disaster Management Act of 2005, as well as the unforeseen national shutdown.

- Furthermore, during the Second Wave, an unprepared administration responded to criticism by declaring health to be a “State topic.”

- Legislations Weakening States’ Autonomy: Legislation is a term that refers to a set of rules or regulations that States’ Autonomy is Being Weakened. Several additional legislation and changes proposed by the Union government in recent years have weakened state authority as well. These include the following: o Farm laws (which have been repealed now)

- Government of National Capital Territory Amendment Act, 2021 o Banking Regulation (Amendment) Act, 2020

- Draft Electricity (Amendment) Bill, 2020 o Indian Marine Fisheries Bill, 2021

- The 2020 National Education Policy

- Taxation Issues: By enlarging the non-divisible pool of taxes in the form of a cess in the petrol tax and implementing the Agriculture Infrastructure and Development Cess, the Union has continued to gain solely from tax collection.

- From 12.67 percent in 2019-20 to 23.46 percent in 2020-21, the non-divisible pool cess and surcharge’s proportion of total taxes collected by the Union government has grown.

- The States’ share of Union tax has been decreased to 30% in the 2021-22 Budget Estimates, compared to the mandatory 41 percent devolution imposed by the 15th Finance Commission.

- GST Issues: Throughout the epidemic, the Union government regularly breached the GST regime’s reimbursement commitments to the States.

- Why The GST compensation period finishes in 2022, despite many requests from the States, and despite multiple pleas from the States, the deadline has not been extended.

- Inadequate Funding: Cash-strapped governments have been looking for non-tax ways to support their programmes.

- The suspension and transfer of MPLAD funding to the Consolidated Fund of India caused a significant problem in most states.

- While the government increased the borrowing ceiling under the Fiscal Responsibility and Budget Management Act (FRBM) from 3% to 5%, it placed some stringent restrictions that make borrowing more difficult for states.

Way Forward :-

- Rethinking Federalism: The above-mentioned policy blunders necessitate further research and reflection on federalism.

- The States should urge the establishment of a clear institutional structure to require and promote interaction between the Union and the States in the Concurrent List’s areas of legislation.

- Strengthening Inter-State Relations: State governments should consider allocating human resources to assist them in preparing replies to the Union’s consultations, particularly with regard to the federalism element.

- Chief Ministers might organise venues for frequent dialogue on this subject instead of merely reaching out to one other during crisis times.

- This would be critical in promoting important demands such as extending GST compensation until 2027 and include cess in the divisible pool of taxes.

- The Key to Public Welfare: The founders of the Constitution wanted to make sure that the public good was served, and the key to that is listening to stakeholders.

- The core of cooperative federalism is consultation and debate, whereas unilateral legislation that does not involve the States can only result in public protests.

- Reforming While Balancing Federalism: India’s diversified population need a fair balance between the pillars of federalism (autonomy of states, centralisation, regionalisation etc). Indian federalism can be weakened by either extreme political centralization or chaotic political decentralisation.

- Appropriate use of the Inter-state Council’s institutional framework is required to foster political goodwill between the Centre and the states on sensitive policy matters.

- The progressive expansion of the states’ budgetary capability must be constitutionally assured without lowering the Centre’s share.

Conclusion :-

The presence or absence of federal flexibility has a significant impact on democracy. As part of the legislative process, the Union government should devote resources to ensuring efficient engagement with states. Establishing a system in which individuals and states are considered as partners rather than subjects is crucial.